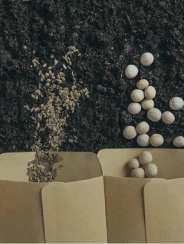

A new stage of agriculture in Kazakhstan

The mission of the credit partnership

A credit partnership that provides financing and documentation services to agricultural producers.

Partnering with a credit partnership is an opportunity to expand your business. Don't worry about long-term commitments before repaying the loan due to unforeseen crop problems or market conditions.

Your ambitions are our investments

Our products

Objective: working capital replenishment

Transfer term: until February of the following year

Rate of interest: 5% p.a.

In equal installments in November of the current year and in February of the following year

Remuneration: concurrently with the principal debt

Commissions: none

Objective: working capital replenishment

Transfer term: until February of the following year

Rate of interest: 5% p.a.

In equal installments in November of the current year and in February of the following year

Remuneration: concurrently with the principal debt

Commissions: none

Stages of concluding long-term cooperation

Scheme of work

What do farmers face?

Support your agribusiness with our credit partnership

- Financing to increase farm productivity;

- Household insurance against risks;

- Expansion of the sales market for products.

- Search for funds to invest in enterprise scaling;

- Credit and financial management;

- Attracting the younger generation to the agricultural business.